Import & Export in the Resource Currency Union (RCU)

The world is more interconnected than ever. Imports and exports determine our global economic system - of both goods and energy. In a globalized world, a sustainable economic system within a new resource currency union (RCU) must therefore be designed in such a way that it also takes into account the interfaces with the rest of the world in order to be able to continue to maintain meaningful trade relations. No less important, however, is to ensure the reliable functioning of the GHG-limiting mode of action of the carbon resource currency ECO, especially at the multilateral level. Without reasonable regulations to counteract this, the quantities of fossil primary energy sources that WE no longer consume would immediately be bought up by other countries of the world via the price mechanism and burned there. The world climate would have nothing at all from it. Because the products produced with it would come as allegedly cheap imports to us, and would counteract so our efforts for climatic protection. This effect must be taken into account, which is why the attempt to reduce fossil fuel consumption by making it more expensive is nonsensical from a global perspective. Therefore, a system is needed that not only works reliably within a carbon resource currency union, but also has an effect on the rest of the world by means of effective border adjustments - according to the motto: ecological thinking in global contexts. After all, countries that have so far refused to join such a RCU would have to realize trade disadvantages if they did not also make their production processes more climate-neutral. This reciprocity would thus have the effect that such countries would also soon want to be "in on the action".

For information: The EU has also recognized this problem. To ensure that cheap but climate-damaging imports do not counteract its own efforts to protect the climate effectively, it is now considering a series of border adjustments with a similar effect. Brussels is already working on carbon import duties on particularly energy-intensive or climate-damaging products. The background to this is that the EU wants to protect its industry from cheap imports as part of the fight against climate change. Since the Community has set itself ambitious climate targets, but their implementation will initially inevitably make its own production more expensive, imports from countries without such requirements are to be subject to CO2 border duties. Exporters from these countries would then have to buy CO2 certificates corresponding to the amount of greenhouse gases emitted for their product. The price of these certificates would be based on the price European industry has to pay for the emission of one ton of CO2. This is planned to take effect from 2026.

A similar mechanism is used in the Alternative Climate Concept: Namely, import and export transactions will be stringently adapted to the ECO system. Within the RWU, it is therefore no longer possible to emit more greenhouse gases than the total emissions budget. It does not matter where in the world the products were produced. The concept does not rely on price surcharges for consumers, but rather the imported goods are adapted to the ECO system according to their GHG content. Due to this cross-border, limiting effect of the parallel currency ECO, the RCU, even through import and export transactions, never exceeds its fixed CO2 budget.

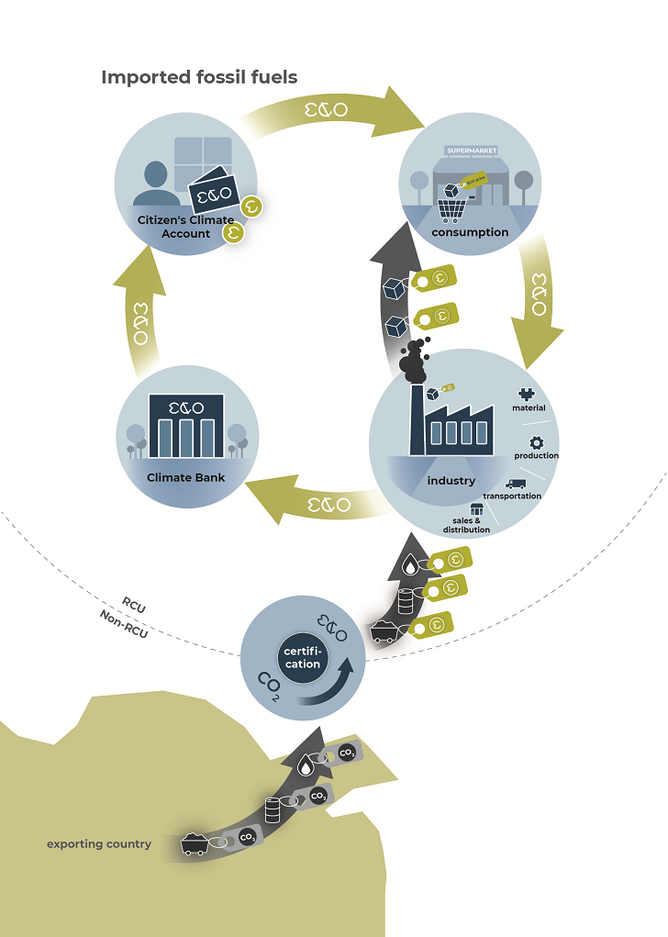

Import of fossil sources into the RCU

Now, one might note that Russia, for example, as a natural gas supplier to the RCU, hardly cares whether within the RCU fossil fuel extraction must be paid for with a limited carbon resource currency. Correct. Of course, the import or export of fossil energy sources must also be covered by a climate concept suitable for everyday use, in addition to trade in goods.

Scenario:

The EU imports gas from Russia, which is not part of the resource currency union. Consequently, the gas source operator does not transfer any ECO to the

climate bank. As a proxy, the first processing company in the EU must pay the specific ECO amount associated with the gas to the Climate Bank. If the resulting end product is sold within the RCU,

the cycle remains stringently closed, as consumers pay for the item with their ECO. This mechanism also applies to the export of goods and is described in more detail in the corresponding

chapter. If, on the other hand, the item is sold outside the RWU, the mechanism described under "Export of goods" applies.

If fossil energy sources are to be imported into the RCU, this additional quota of climate gas emissions must be consistently adapted to the ECO carbon resource currency system. As a reminder, if fossil energy from the RCU itself is used, all companies involved in the value chain must ultimately pay their consumption with the corresponding amount of the ECO carbon resource currency to the producing companies, which in turn must pay their share to the Climate Bank according to the amount produced.

Instead of the RCU internal production companies, the imported fossil primary energy is now used. In this case, the companies involved in the value creation must now pay the resource currency directly to the Climate Bank. In this way, the cycle of the resource currency system remains closed and it continues to be ensured that only as much climate-damaging consumption can be made as ECO is in circulation. The limitation of fossil energy use within the RWU remains guaranteed, due to the limited personal emission quotas available to consumers. The system remains stringently self-contained.

Incidentally, this is also how economic trading pressure is created for countries that are not yet members of the RCU.

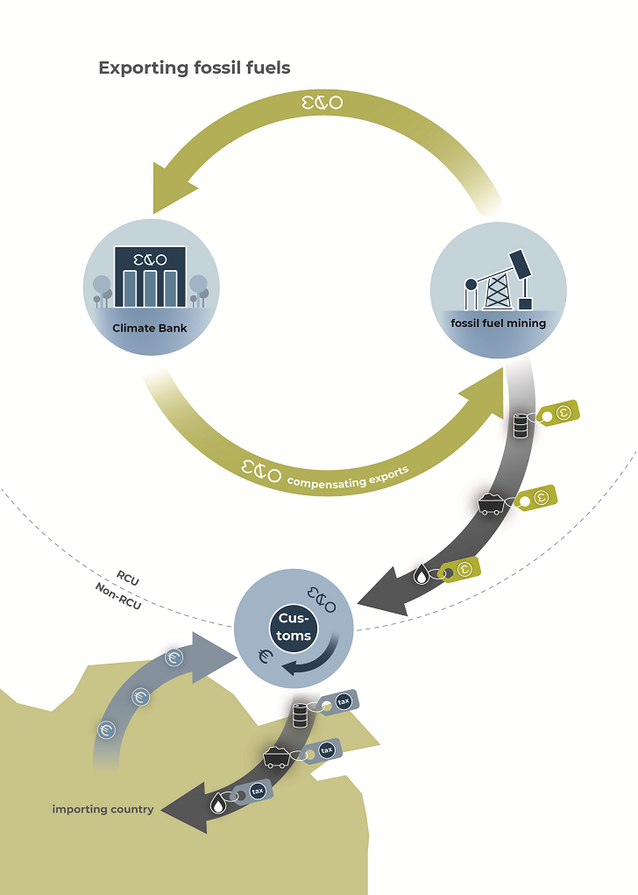

Export of fossil sources from the RCU

The extraction companies within the RCU must pay ECO to the Climate Bank for the quantities of fossil fuels extracted - also for exports. However, since there are no ECO revenues from production and consumption from the RCU, the exporter is reimbursed directly by the Climate Bank for the ECO charged, as a compensation payment.

However, buyers outside the RCU must pay the ECO price of the fossil fuels, as an equivalent in monetary currency, according to the current daily rate on the climate exchange, in addition to the purchase price, as a CO2 duty. . This increases the incentive to favor fossil fuels with a lower CO2 content and the lowest possible energy production costs.

Import of goods into the RCU

The RCU is a closed system in which ECOs are exchanged for fossil consumption in order to ensure that consumers within the Union cannot consume more climate-damaging goods and services than their rationed quota.

If, on the other hand, goods from outside the RCU enter this market, they must be adapted to the system when imported. This is because producers outside the EU do not have to pay ECO. Instead, the importer within the RCU must pay the ECO amount associated with the imported goods to the Climate Bank. For this purpose, the goods must be assessed and certified according to their climate gas content in terms of material extraction, production and transport. The importer then transfers the ECO amounts of these goods directly to the Climate Bank instead of, as is otherwise customary, to its upstream units within the RCU. He recovers the expensed ECO, just as he does when he purchases the goods from upstream stages within the RCU, by reselling them to downstream stages, until ultimately paying for them with consumers' ECO. In this way, it remains ensured that RCU citizens can only consume climate-damaging goods to the extent that ECO are in circulation. The limitation of CO2 consumption within the RCU remains guaranteed by the limited volume of the resource currency. The system remains stringently self-contained. Here, too, an economic trading pressure is created for countries that are not yet participants in the RCU.

Export of goods from the RCU

Goods produced in the RCU are subject to customs duties when they are exported. This is because they were produced within the closed ECO cycle using the limited fossil fuels, priced using the carbon resource currency ECO and invoiced through the individual process stages. However, since the external buyer cannot pay for these goods with ECO, the seller is reimbursed directly by the Climate Bank for the amount of ECO charged for his products. This compensation is necessary because in this particular case no RCU end customer buys these goods and pays with his budget. Indeed, the circulation of the resource currency must not be interrupted by the export of goods. The amount of this CO2 duty corresponds to the current daily rate of the ECO on the climate exchange, and is paid in addition to the purchase price of the goods in the national currency of the exporting country. This ensures that companies producing for customers outside the RCU still have an incentive to produce these goods in a climate-friendly way. This is because products with low ECO costs are thus more attractive not only to customers within the Union, but also to the rest of the world. Here, too, the system remains effectively self-contained.

Consumption Resource Chains Import/Export

Within the RCU, no more greenhouse gas emissions from imports and exports may be permitted than the scientifically determined quotient. The trading interfaces with other countries must be designed in such a way that the total volume permitted within the member states is not undermined. Therefore, import and export transactions must be adapted to the resource currency ECO. The aim is that citizens within the RCU cannot overconsume their CO2 budget, regardless of where the products were manufactured or where in the world fossil fuels were extracted.

Import:

Export:

What are the benefits:

- The remaining total emissions budget is also met through trade relations with non-RMU countries.

- By applying border adjustments for imports and exports, the ECO cycle system remains stringently closed.

- Third countries are motivated to join the RWU, so that the certification of their products is omitted or a duty in national currency for fossil produced goods or energy sources from the RWU is avoided.

- RWU products receive a sales-promoting, honest, green image, similar to the "Made in Germany" label for outstanding quality.

Copyright:

The copyright of all contents of this website lies solely with us. However, we expressly agree that the texts and graphics, including excerpts, may be used or distributed.

You can do it, too! Sign up for free now at https://www.jimdo.com